The Best Strategy To Use For Personal Loans Canada

The Best Strategy To Use For Personal Loans Canada

Blog Article

The 6-Second Trick For Personal Loans Canada

Table of ContentsPersonal Loans Canada Things To Know Before You Get ThisThe Definitive Guide to Personal Loans CanadaRumored Buzz on Personal Loans CanadaPersonal Loans Canada Things To Know Before You BuyThe Facts About Personal Loans Canada Uncovered

For some lenders, you can check your qualification for an individual lending via a pre-qualification process, which will show you what you may qualify for without dinging your credit report. To ensure you never miss a car loan repayment, take into consideration establishing up autopay if your loan provider uses it. Sometimes, you may also obtain a passion price discount for doing so.This consists of:: You'll need to confirm you have a work with a stable revenue so that you can pay back a financing., and various other information.

:max_bytes(150000):strip_icc()/how-apply-personal-loan.asp-final-e0c4e2e22f254e54a6cdf927b0a4f8ab.jpg)

What Does Personal Loans Canada Do?

However, a fair or negative credit history may limit your choices. Individual finances also have a couple of costs that you need to be prepared to pay, including an origination cost, which is utilized to cover the cost of refining your loan. Some lending institutions will certainly allow you pre-qualify for a loan before sending an actual application.

This is not a hard credit history draw, and your debt score and background aren't impacted. A pre-qualification can aid you remove loan providers that will not provide you a funding, yet not all loan providers supply this alternative. You can compare as lots of lenders as you would certainly such as through pre-qualification, by doing this you just have to complete an actual application with the lending institution that's most likely mosting likely to authorize you for a personal funding.

The higher your credit report, the more probable you are to receive the cheapest passion price used. The lower your rating, the tougher it'll be for you to get a loan, and also if you do, you might wind up with a rate of interest on the higher end of what's provided.

The Of Personal Loans Canada

Autopay allows you set it and forget it so you never have to fret concerning missing a financing payment.

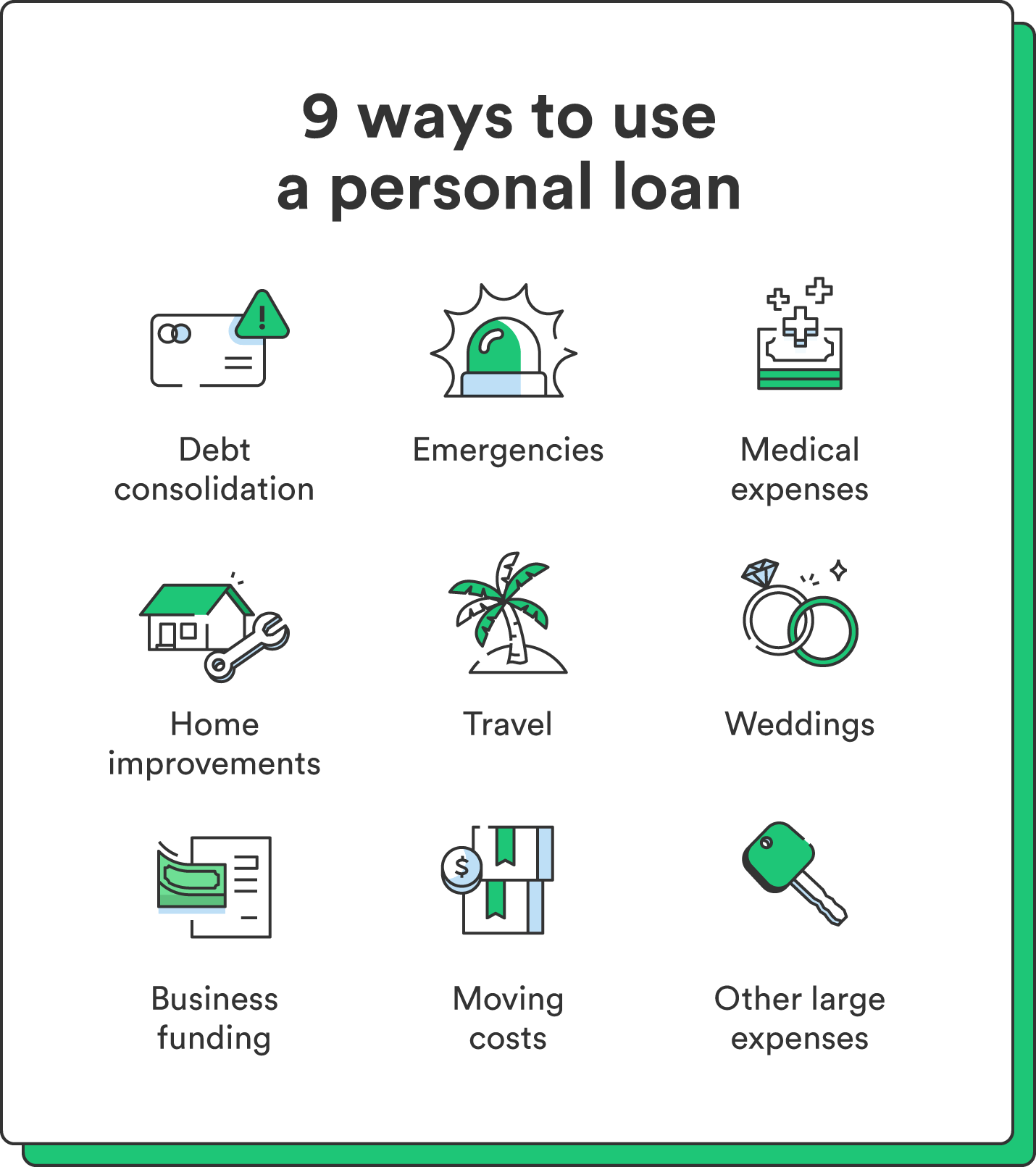

The customer does not need to report the quantity obtained on the funding when filing tax obligations. If the financing is forgiven, it is thought about a terminated financial debt and can be strained. Investopedia commissioned a national survey of 962 U.S. adults between Aug. 14, 2023, to Sept. 15, 2023, who had actually secured an individual financing to learn exactly how they utilized their car loan profits and just how they may utilize future individual fundings.

Both personal financings and bank card are two choices to obtain cash up front, but they have different objectives. Consider what you need the cash for prior to you select your payment choice. There's no wrong selection, however one can be a lot more pricey than the other, relying on your needs.

They aren't for everybody my company (Personal Loans Canada). If you discover here do not have a co-signer, you may certify for a personal loan with bad or reasonable credit scores, yet you might not have as numerous alternatives contrasted to someone with excellent or outstanding credit history.

Not known Factual Statements About Personal Loans Canada

A credit history of 760 and up (excellent) is most likely to obtain you the most affordable rates of interest readily available for your finance. Customers with credit history of 560 or below are most likely to have trouble getting approved for far better funding terms. That's because with a reduced credit rating, the interest price tends to be expensive to make an individual car loan a viable loaning alternative.

Some elements bring even more weight than others. 35% of a FICO rating (the kind utilized by 90% of the lending institutions in the nation) is based on your repayment history. Lenders wish to make sure you can handle finances responsibly and will certainly check out your previous behaviour to get an idea of exactly how accountable you'll be in the future.

In order to maintain that section of your score high, make all your payments on schedule. Can be found in 2nd is the quantity of bank card financial obligation impressive, family member to your credit score limitations. That represents 30% of your credit rating and is known in the industry as the debt usage ratio.

The lower that ratio the far better. The length of your credit rating, the kind of credit rating you have and the variety of new credit applications you have actually recently filled up out are the various other elements that determine your credit history. Outside of your credit rating rating, lending institutions take a weblink look at your revenue, job background, liquid properties and the amount of total debt you have.

3 Easy Facts About Personal Loans Canada Shown

The higher your earnings and properties and the reduced your other debt, the better you look in their eyes. Having a great credit rating when getting an individual funding is very important. It not just determines if you'll obtain authorized yet how much interest you'll pay over the life of the funding.

Report this page